An economic total loss of your car – a nightmare for every car owner. But what actually happens when repair costs exceed the replacement value? What does the insurance pay in this case? This article clarifies all important questions about “economic total loss” and insurance payouts.

What Does “Economic Total Loss” Mean?

An economic total loss occurs when the repair costs of the damaged vehicle are higher than its replacement value. The replacement value is the amount you need to purchase a comparable vehicle. Unlike a technical total loss, where the vehicle cannot be repaired, repair is possible with an economic total loss, but it is not economically reasonable.

How Is the Insurance Payout Calculated for Economic Total Loss?

The insurance payout is based on your vehicle’s replacement value minus the residual value. The residual value is the amount you can still get for your damaged vehicle, for example, by selling it to a buyer. Simply put: Insurance Payout = Replacement Value – Residual Value.

“Correctly calculating the replacement value is crucial for a fair insurance payout,” emphasizes automotive expert Dr. Hans Müller in his book “Economic Total Loss: A Guide.”

What to Do in Case of Economic Total Loss?

Stay calm and inform your insurance company immediately. Have the damage assessed by an independent appraiser. This is important to correctly determine the replacement value and the residual value. Compare offers from different buyers for your damaged vehicle. This ensures you get the best possible residual value.

Which Factors Influence the Replacement Value?

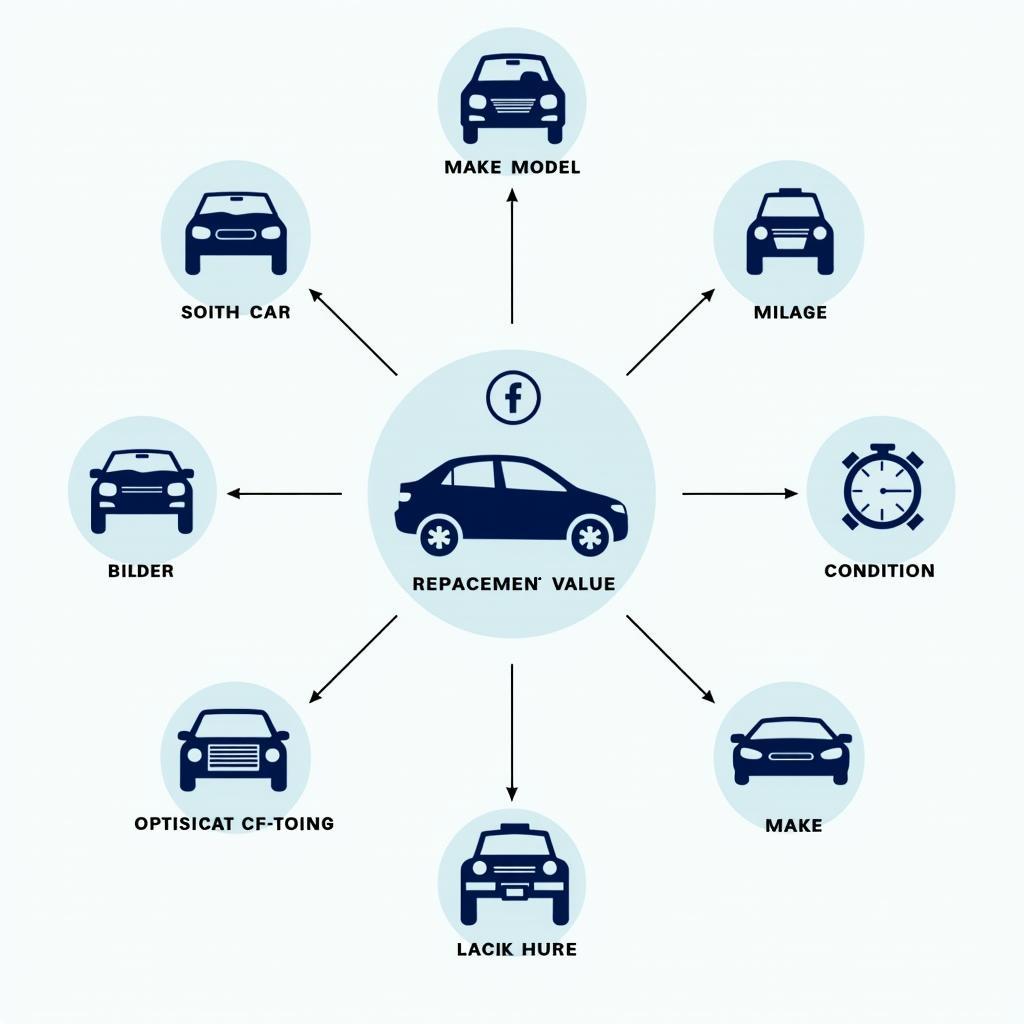

The replacement value depends on various factors, such as the make, model, year of manufacture, mileage, equipment, and condition of your vehicle before the accident. A well-maintained car with low mileage has a higher replacement value than a comparable vehicle with high mileage and signs of wear.

Factors influencing replacement value

Factors influencing replacement value

Imagine your almost-new sports car is involved in an accident. In this case, the replacement value will be significantly higher than for an older small car with high mileage.

Can I Keep My Vehicle After an Economic Total Loss?

Yes, that is possible. In this case, the insurance payout is reduced by the residual value you would have received by selling the vehicle. You can then repair the vehicle yourself or continue driving it as it is. However, keep in mind that repairs may be more expensive than the insurance payout received.

Where Can I Find More Information?

On autorepairaid.com, you will find more helpful articles and information about car repair and automotive technology. Visit our website for expert tips and practical guides.

Frequently Asked Questions About Economic Total Loss

- What is the difference between economic and technical total loss?

- How do I find an independent appraiser?

- Can I choose the buyer freely?

- What happens if I don’t agree with the appraiser’s assessment?

More Articles on autorepairaid.com

- Diagnostic tools for car fault analysis

- DIY car repair manuals

Need Support?

Our car repair experts are available 24/7 to assist you. Contact us via our website autorepairaid.com if you have questions or need help.

What Insurance Pays for Economic Total Loss – Summary

In summary, in the case of an economic total loss, insurance pays the replacement value minus the residual value. It is important to have the damage assessed by an independent appraiser and obtain offers from different buyers to achieve the best possible residual value.

Contact us today for a free consultation!