Do you dream of owning your own home, but the path seems financially insurmountable? Don’t worry, with home financing from Smava, you can turn your housing dreams into reality. Smava is an online loan portal that allows you to compare different financing options from banks and savings banks.

What is Home Financing?

Before we dive deeper into Smava home financing, let’s first clarify the basics. Imagine you’re a car mechanic and want to buy a new car lift for your workshop. However, the purchase exceeds your available budget. In this case, you can take out a loan to finance the lift.

This is exactly how it works with building or buying a house. Home financing is essentially nothing more than a loan specifically intended for building or purchasing real estate.

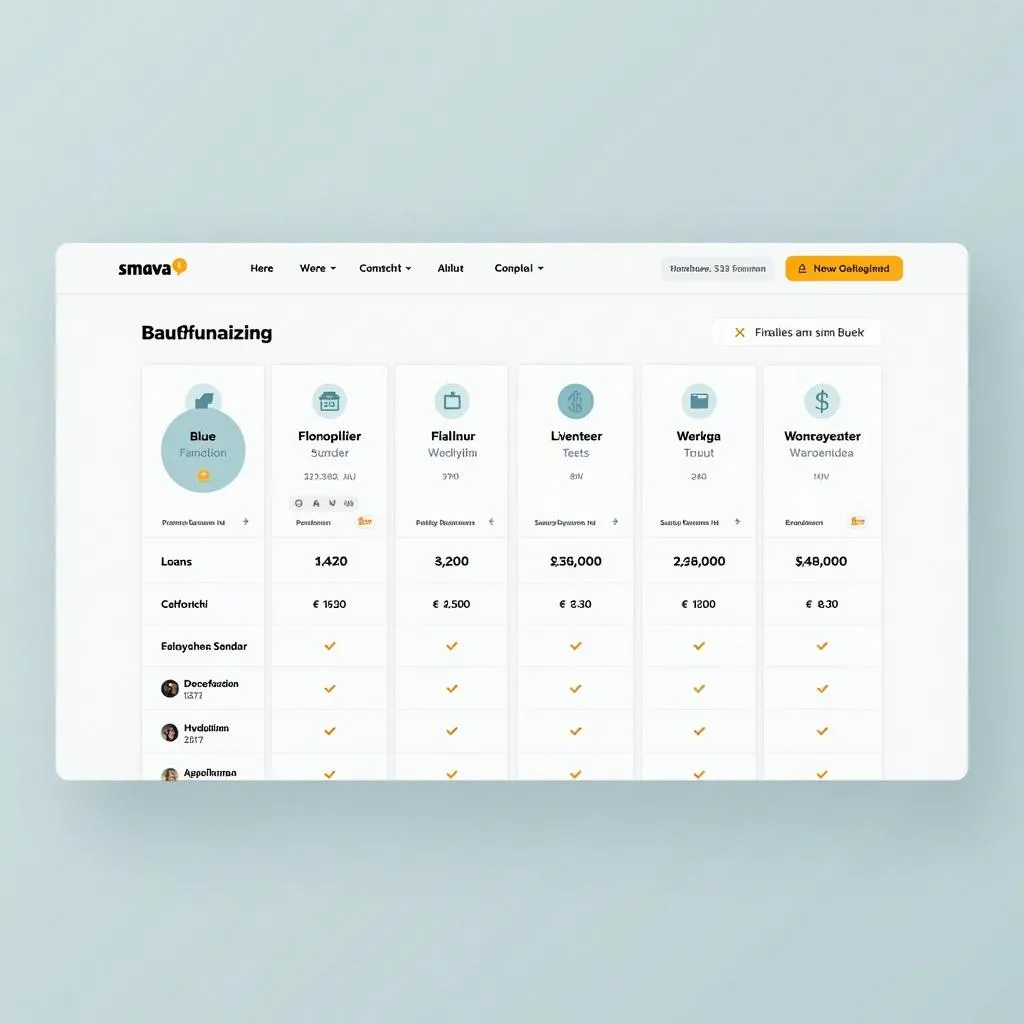

Smava Home Financing Comparison

Smava Home Financing Comparison

Advantages of Home Financing with Smava

Finding the right home financing can be time-consuming and complex. Smava takes this work off your hands and offers you numerous advantages:

- Simple Online Comparison: Compare offers from over 20 banks and savings banks with just a few clicks.

- Individual Terms: Find the home financing that perfectly suits your needs.

- Fast and Uncomplicated Processing: Save time and hassle thanks to digital processes.

- Personal Consultation: Get free advice from experienced financing experts.

How to Find the Right Home Financing with Smava

The path to optimal home financing with Smava is simple:

- Enter your details: On the Smava website, you’ll be asked about your financing wishes and financial situation.

- Compare offers: Smava shows you an overview of the best offers from various banks.

- Select the best offer: Compare the terms in detail and choose the home financing that best suits you.

- Apply for your financing online: Fill out the digital application and upload the necessary documents.

Home Financing Calculator

Home Financing Calculator

What to Consider When Choosing Home Financing

- Interest Rate: A low interest rate is crucial for the overall cost of your financing.

- Amortization Rate: The amortization rate determines how quickly you repay your loan.

- Special Repayment Options: The possibility of making special repayments offers you flexibility.

- Commitment Interest: Pay attention to the lowest possible commitment interest.

Conclusion

Home financing with Smava paves your way to owning a home. Use the free and non-binding comparison to find the best terms. With the right financing and expert advice, your dream of owning a home will become a reality.

Visit autorepairaid.com now for more information on financing and find helpful tips for buying and repairing cars.