Psa Leasing – a term that comes up more and more frequently in connection with purchasing a new vehicle. But what exactly lies behind it, and what advantages does a PSA leasing contract offer compared to traditional car buying? This article provides you with comprehensive information on PSA Leasing and offers valuable tips for your decision. Learn everything about the conditions, costs, and specific features of leasing from PSA. PSA Car Subscription offers further information on this topic.

Leasing, particularly PSA Leasing, is becoming increasingly popular. But what exactly is behind this financing model? Simply put, with leasing, you rent a vehicle for a fixed period and mileage. At the end of the term, you simply return the car. While this sounds straightforward, there are also a few points to consider. Below, we highlight the most important aspects of PSA Leasing.

What is PSA Leasing?

PSA Leasing refers to leasing contracts offered by the PSA Group, to which brands like Peugeot, Citroën, DS Automobiles, and Opel belong. It is an attractive alternative to traditional car buying, especially for private customers and business owners who want to drive a new vehicle regularly. A key advantage is that you only pay for the use of the vehicle, not for its entire value. “The flexibility that a leasing contract offers is a decisive factor for many customers,” says Dr. Hans Müller, a financial expert in the automotive industry, in the book “Modern Vehicle Financing”.

Advantages and Disadvantages of PSA Leasing

Advantages and Disadvantages of PSA Leasing

Advantages of PSA Leasing

PSA Leasing offers numerous advantages. You always drive the latest models and benefit from modern technology and safety features. Monthly rates are generally lower than with financing, and you are not tied to a vehicle for the long term. This provides you with financial flexibility and planning certainty. Furthermore, the effort of reselling the vehicle is eliminated. Leasing offers are often particularly attractive in combination with service and maintenance packages.

Disadvantages of PSA Leasing

Of course, there are also some points to consider with PSA Leasing. The mileage is contractually fixed, and exceeding it incurs additional costs. You also have to pay for damages to the vehicle that go beyond normal wear and tear at the end of the term. Another aspect is that you do not own the vehicle at the end of the term. PSA Bank Interest Rates might be interesting for you if you are looking for alternative financing options.

PSA Leasing Costs: What You Need to Consider

The costs for a PSA lease are made up of various factors. These include the amount of the down payment, the contract term, the agreed mileage, and, of course, the vehicle model itself. Optional extras and additional services also influence the monthly leasing rate. Therefore, compare offers from different dealers and pay attention to hidden costs.

PSA Leasing for Business Customers

For business customers, PSA Leasing offers attractive opportunities. Leasing rates can be tax-deductible, and the calculable costs facilitate financial planning. In addition, companies benefit from constantly renewing their fleet, presenting themselves as modern and innovative. “For companies, leasing is often the most economical solution,” says Prof. Eva Schmidt, an automotive industry expert, in her work “Fleet Management in the 21st Century”.

Alternatives to PSA Leasing

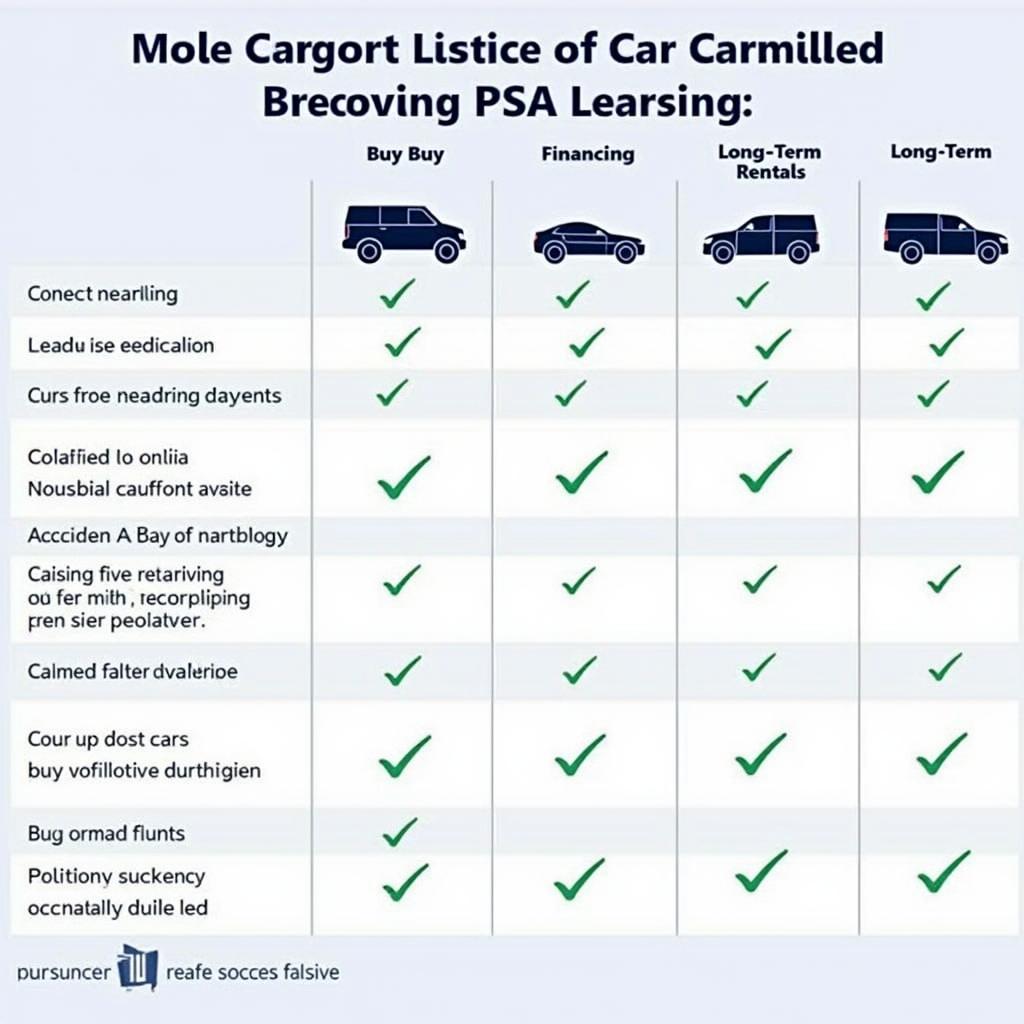

In addition to leasing, there are, of course, other ways to finance a vehicle. These include the classic cash purchase, financing through a loan, or long-term rental. The best option for you depends on your individual needs and financial situation.

Alternatives to PSA Leasing

Alternatives to PSA Leasing

Conclusion: PSA Leasing – A Flexible Alternative

PSA Leasing can be an attractive alternative to buying a car, especially if you want to drive a new vehicle regularly and value calculable costs. Inform yourself thoroughly about the conditions and compare offers from different dealers. This way, you will find the right leasing offer for your needs. Feel free to contact us if you have further questions about PSA Leasing. Our experts are available to you 24/7.

Frequently Asked Questions about PSA Leasing

- What happens at the end of the leasing term?

- Can I adjust the mileage during the term?

- What insurance do I need for leasing?

- Can I return the leased vehicle early?

More Interesting Topics on autorepairaid.com:

- Maintenance and Repair of PSA Vehicles

- Diagnostic Tools for PSA Models

- Training and Further Education in Automotive Technology

Do you have questions about car repairs or need support with vehicle diagnostics? Don’t hesitate to contact us! We offer professional help and expert knowledge on everything related to car repair. Visit our website autorepairaid.com for more information.