A balloon payment car loan offers you the opportunity to drive your dream car without having to pay the entire purchase price upfront. You pay lower monthly installments because a portion of the purchase price is only due at the end of the loan term – the so-called balloon payment. But how exactly does this type of financing work, and what are its advantages and disadvantages? This article sheds light on balloon payment car loans from all angles and gives you valuable tips for your decision.

Are you dreaming of a new car, but the full purchase price exceeds your budget? Balloon payment financing could be the solution. Audi Bank Financing Phone. With this type of financing, you pay lower monthly installments than with a classic loan, as part of the purchase price is only due at the end of the term. But is this option really as attractive as it seems at first glance?

What is Balloon Payment Car Financing?

Balloon payment car financing, also known as a balloon loan, is a special form of car financing. It is characterized by comparatively low monthly installments, as a significant portion of the total amount, the balloon payment, is only paid at the end of the loan term. This balloon payment can vary depending on the agreement and influences the amount of the monthly payments.

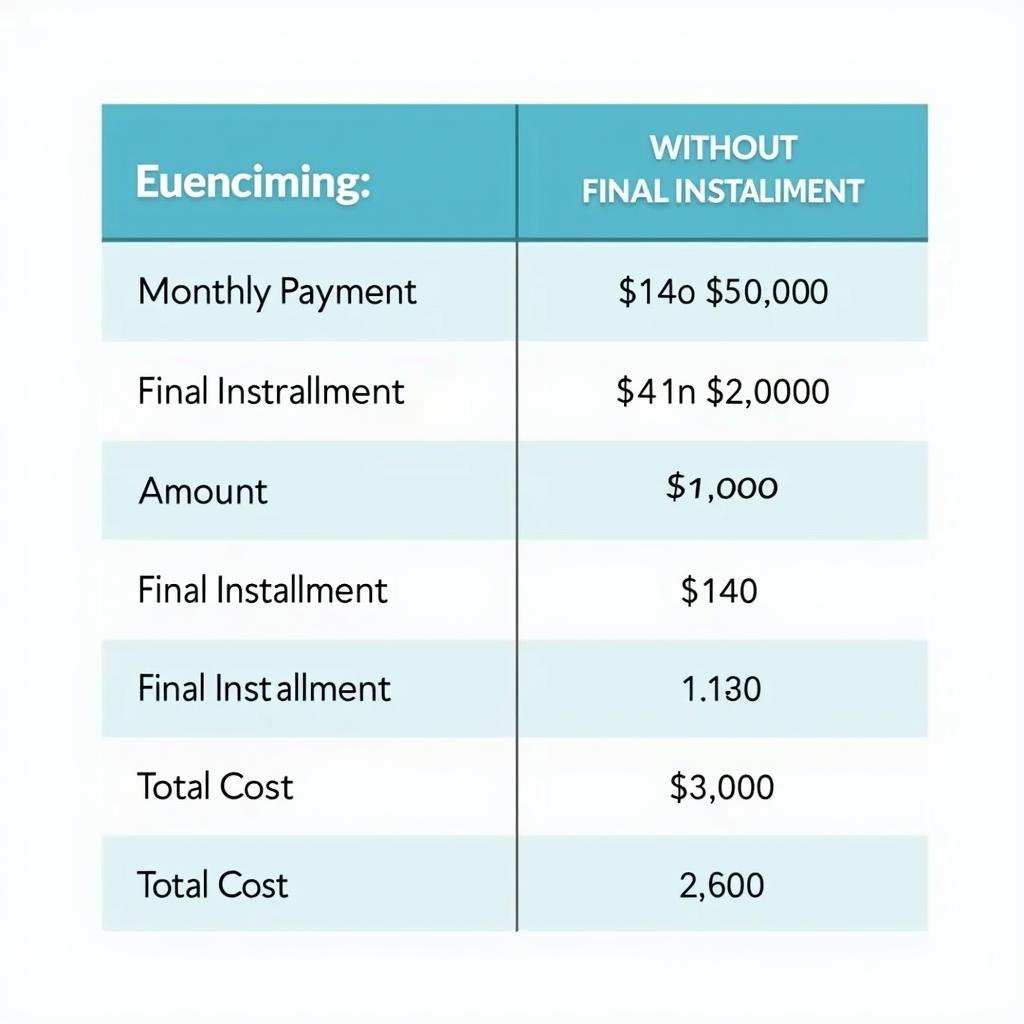

Balloon car financing comparison chart showing pros and cons

Balloon car financing comparison chart showing pros and cons

Advantages and Disadvantages of Balloon Payment Car Financing

Balloon payment financing offers some advantages but also involves certain risks. A clear advantage is the low monthly burden, which allows you to drive a more expensive vehicle than would be possible with classic financing. After the contract term expires, you have several options: you can pay the balloon payment and keep the vehicle, return the vehicle, or take out follow-up financing for the balloon payment. Car Leasing without Schufa Experience. A disadvantage, however, is that the total cost of financing is often higher than with classic financing due to the interest on the balloon payment. You also need to think early on about how you want to settle the balloon payment.

Tips for Balloon Payment Car Financing

Before you decide on balloon payment car financing, you should carefully analyze your financial situation and consider how you want to pay the balloon payment at the end of the term. It is best to save a monthly amount during the term so that you can easily pay the balloon payment at the end. Compare different offers and pay attention not only to the amount of the monthly installments but also to the total cost of financing. Mercedes Bank Financing Requirements. “A well-planned financial plan is the key to successful car financing,” says renowned financial expert Hans Müller in his book “Car Financing for Dummies”.

Alternatives to Balloon Payment Car Financing

In addition to balloon payment financing, there are other ways to finance a vehicle, such as a classic car loan or leasing. Which form of financing is right for you depends on your individual needs and financial situation. Carefully compare the different options before making a decision. Car Financing Commercial. Good advice from an independent financial expert can help you find the optimal solution for your needs.

Conclusion: Balloon Payment Car Financing – Yes or No?

Balloon payment car financing can be an attractive option if you want to drive your dream car but keep the monthly burden low. However, you should be aware of the risks and carefully plan how you want to settle the balloon payment at the end of the term. Compare different offers and seek advice from an expert if necessary to make the best decision for your individual situation. Please feel free to contact us via our website if you need support with car financing. Our experts are available 24/7.