Understanding car insurance costs, especially for Class A1 vehicles in Germany, is crucial. This article breaks down everything you need to know about A1 insurance costs, helping you make informed decisions for your vehicle and budget.

What Does A1 Car Insurance Mean?

“A1 Car Insurance Costs” refers to the cost of third-party liability insurance for vehicles classified as A1. Each vehicle class represents a specific risk level covered by the insurance. Class A1 is the most affordable, assigned to vehicles with the lowest risk.

“Being classified in A1 offers a significant advantage,” explains car expert Klaus Müller. “Drivers benefit from lower insurance premiums and substantial savings.”

Factors Influencing A1 Insurance Costs

While Class A1 generally offers lower rates, several factors can still influence the exact cost:

- Vehicle Type: Even within A1, costs vary depending on the specific model.

- Mileage: High-mileage drivers face higher premiums than low-mileage drivers.

- No-Claims Bonus: A longer accident-free history results in lower premiums.

- Regional Class: Areas with higher traffic density and accident rates have higher insurance costs.

- Policyholder: The driver’s age, gender, and driving experience also play a role.

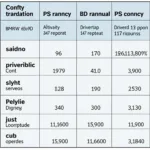

Car insurance comparison chart

Car insurance comparison chart

Finding the Cheapest A1 Insurance

Comparing quotes from different providers is key to finding the cheapest A1 insurance. Use an online comparison tool and enter your specific details for a quick overview of various rates and conditions.

Tip: Don’t focus solely on price; consider the coverage offered as well.

What Does A1 Insurance Cover?

Third-party liability car insurance is mandatory in Germany, covering damages you cause to others with your vehicle. This includes:

- Personal Injury

- Property Damage

- Financial Losses

Beyond mandatory coverage, you can add optional coverage like:

- Partial Comprehensive: Covers damage to your vehicle from theft, fire, wildlife accidents, or natural disasters.

- Fully Comprehensive: Offers the most comprehensive protection, covering damage to your vehicle even in at-fault accidents.

Car insurance contract

Car insurance contract

A1 Insurance Costs – Conclusion

A1 insurance costs offer an affordable way to insure your vehicle. Compare quotes from different insurers to find the best fit for your needs. This ensures optimal protection and peace of mind on the road.

Have questions about A1 insurance costs? Contact us! Our experts offer personalized, no-obligation advice.