As a proud BMW owner, you understand that your vehicle is more than just transportation. It’s a statement, a symbol of performance and elegance. Just as crucial as maintaining your BMW is securing the right insurance coverage. “BMW car insurance” – these three words encompass a world of options and decisions that deserve careful consideration.

What Does “BMW Car Insurance” Actually Mean?

“BMW car insurance” refers to vehicle insurance specifically tailored to the needs of BMW drivers. Unlike standard policies, these insurance plans take into account the unique characteristics and value of your BMW.

Why is Specific Car Insurance Sensible for My BMW?

You might wonder, “Isn’t regular car insurance sufficient?”. The answer is: Not necessarily.

A BMW is generally more expensive to purchase and repair than many other vehicles. This is reflected in insurance premiums. Specialized BMW car insurance considers these factors and offers you more comprehensive protection.

Which Benefits Should a Good Car Insurance for BMWs Include?

Choosing the right car insurance depends on your individual needs. However, some benefits are particularly recommended for BMW drivers:

- Comprehensive Coverage: Offers optimal protection against accidents you cause and vandalism.

- Collision Coverage: Protects you against damage from theft, fire, storm, hail, or collisions with animals.

- Roadside Assistance: Provides additional services such as breakdown assistance, towing, and a replacement vehicle.

- GAP Insurance: Closes the financing gap in case of total loss or theft, if the replacement value is lower than the outstanding loan amount.

“Choosing the right car insurance is like choosing the right engine oil – crucial for the longevity and value retention of your BMW,” says Dr. Markus Schmidt, financial expert and author of the book “Cleverly Insured – Even with a BMW”.

What Should I Consider When Choosing Car Insurance for My BMW?

- Benefits and Coverage Amounts: Compare the offered benefits and coverage amounts of different insurance policies.

- Deductible: Choose a deductible that fits your budget.

- Premium Amount: Compare the premiums of different insurance companies. Consider not only the price but also the benefits.

- Customer Reviews: Learn about other customers’ experiences with the respective insurance company.

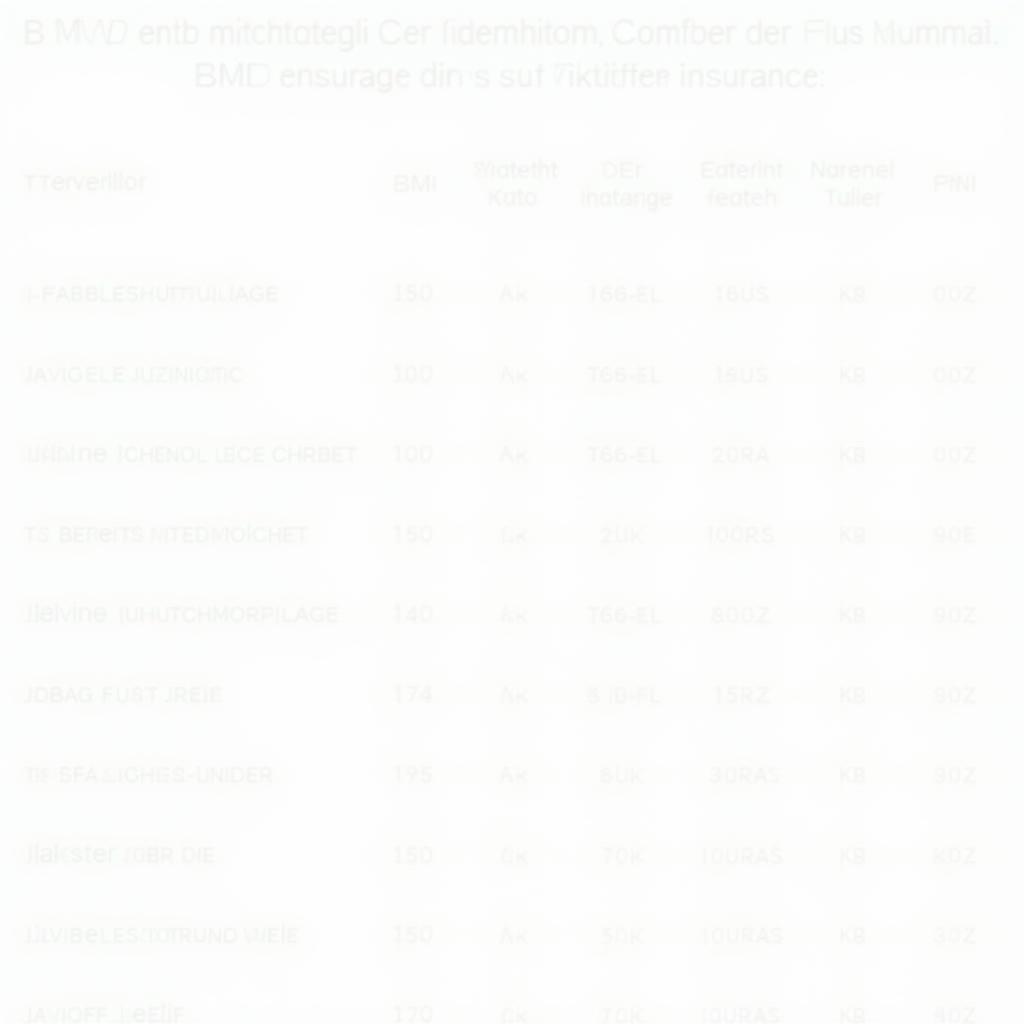

Chart comparing different car insurance options

Chart comparing different car insurance options

Frequently Asked Questions About Car Insurance for BMWs

Question: Is car insurance for BMWs more expensive than for other vehicles? Answer: Yes, premiums for BMWs are generally slightly higher because repair costs and the risk of theft are higher.

Question: Do I need comprehensive coverage for my new BMW? Answer: For a new or high-value BMW, comprehensive coverage is generally recommended as it offers the best possible protection.

Conclusion: Drive Worry-Free with the Right Car Insurance

Choosing the right car insurance for your BMW is an important decision. Take your time, compare different offers, and choose a policy that meets your individual needs and budget.

Visit our website for more information and helpful tips on the topic of car insurance for BMWs. Our team of car experts is happy to assist you with any questions!