Considering a new job and wondering how much of 2658 gross salary will actually end up in your bank account? This is an important question, as the amount remaining after all taxes and social contributions are deducted is crucial for your financial planning. In this article, you’ll learn everything you need to know about calculating 2658 gross to net salary.

What Does 2658 Gross to Net Mean?

The term “gross” refers to the salary your employer pays you before any deductions. “Net,” on the other hand, is the amount that is actually available to you after all taxes and social contributions have been deducted.

Diagram illustrating gross salary to net take-home pay calculation

Diagram illustrating gross salary to net take-home pay calculation

Key deductions include:

- Income Tax: The amount of income tax depends on your tax class.

- Solidarity Surcharge: The solidarity surcharge is 5.5% of your income tax.

- Church Tax: If you belong to a church, you have to pay church tax. The amount varies depending on the federal state.

- Social Insurance Contributions: You pay contributions to health, long-term care, pension, and unemployment insurance.

How Do I Calculate 2658 Gross to Net?

Calculating 2658 gross to net is complex and depends on various factors, such as:

- Tax Class: There are six tax classes that take marital status and the number of children into account.

- Federal State: In some federal states, taxes are higher than in others.

- Obligation to Pay Church Tax: Whether and how much church tax you pay depends on your federal state and denomination.

- Tax Allowances: There are various tax allowances that can reduce your taxable income.

“A common mistake in salary negotiations is to only focus on the gross salary. It’s important to keep the net salary in mind,” says financial advisor Anna Schmidt. “Don’t forget that insurance and other expenses must also be deducted from the net salary.”

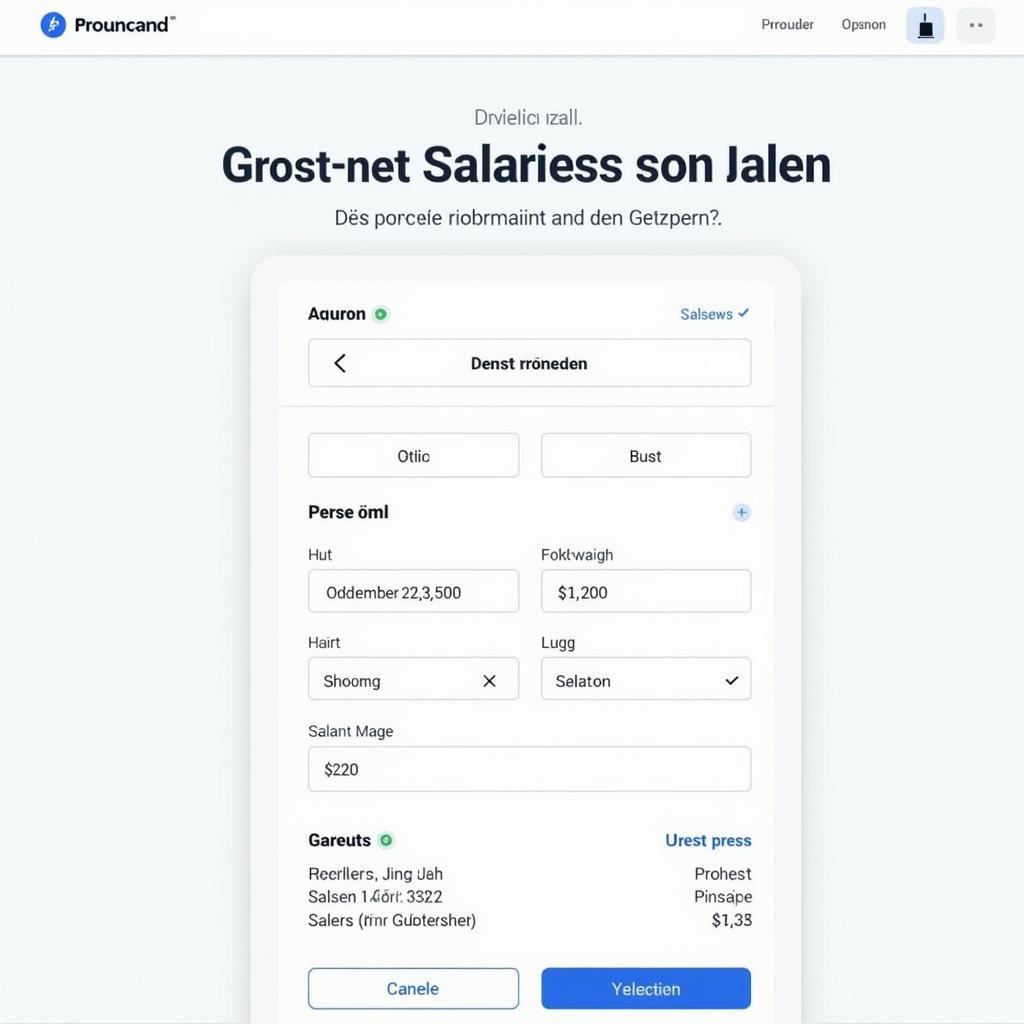

Screenshot or graphic depicting an online gross to net salary calculator tool

Screenshot or graphic depicting an online gross to net salary calculator tool

Tools for Calculating 2658 Gross to Net

There are various online tools that make it easier for you to calculate 2658 gross to net salary. These tools consider all relevant factors and quickly and easily provide you with a reliable result.

Conclusion

Calculating 2658 gross to net is complex and depends on various factors. However, with the help of online tools, you can quickly and easily determine how much money is actually available to you in the end.

Do you still have questions about gross-net calculation or other topics related to cars? Then feel free to contact us via our website. Our team of experts is happy to help you with advice and assistance!